Don't search "how to sell a car in Kansas" and hope for good results. Use our Car Value Calculator to get a precise quote of your vehicle's worth.

- Wichita

- Kansas City

- Olathe

- Overland Park

- Topeka

- Lawrence

- Lenexa

- Manhattan

Accurate car valuation with our Car Value Calculator, factoring in real-time market data.

Access trusted Kansas car dealers buying used cars like yours right now.

More competition = better offers. Let buyers compete for your vehicle.

We handle vehicle transport once a sale is finalized.

Selling your car online privately in Kansas can take weeks or months without help.

You'll need to advertise on multiple platforms, likely spending hundreds of dollars.

You are responsible for every step, including booking your own Kansas auto transport.

Selling a car online through sites like CarGurus and Carvana usually results in lower payouts.

Don't search "how to sell a car in Kansas" and hope for good results. Use our Car Value Calculator to get a precise quote of your vehicle's worth.

Our network of top Kansas car dealers competes for your vehicle, ensuring you get the best possible offer.

Our experts manage the logistics, so you don't have to. Once you strike a deal, we'll manage the auto transport.

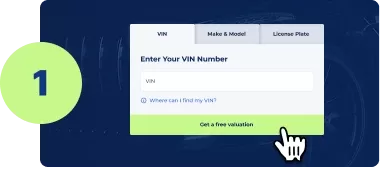

Enter your VIN, license plate number, or vehicle details to receive an instant and accurate quote.

Use your appraisal to negotiate with multiple buyers in our network. Choose between cash offers or trade-in options.

Once you finalize the sale, we’ll arrange vehicle transport to take the stress off your plate.

You need the following forms when selling your vehicle in Kansas:

· The vehicle title

· A completed Kansas Department of Revenue (DOR) Bill of Sale (Form TR-312)

· An Odometer Disclosure Statement (if required)

You'll need to apply for a duplicate if the title is lost.

Yes, in Kansas, the seller must remove the license plates before the buyer takes possession of the vehicle.

Yes, you can transfer your plates to another vehicle you own. You must register the new car and provide proof of insurance.

To transfer a car title in Kansas:

· The seller signs the title over to the buyer.

· Both parties complete the Odometer Disclosure Statement (if applicable).

· The buyer registers the vehicle with the Kansas Department of Revenue and pays any applicable fees.

· A Lien Release (Form TR-150) may be required if there is a lien on the vehicle.

Yes, when you purchase a car privately or from a dealer in Kansas, you'll pay a minimum of 6.5% sales tax, depending on country tax rates.

Car sellers do not pay sales tax in Kansas. That is the responsibility of the buyer. However, you may have to pay capital gains taxes if you made a profit off the sale.

Yes, a title is required to transfer car ownership in Kansas. If lost, the seller must apply for a duplicate title before selling.

No, Kansas does not currently offer online title transfers. You must complete a title transfer at a county treasurer's office.

Yes, car sellers must fill out a Bill of Sale (Form TR-312) to document the transaction.

No, a notarized bill of sale is not required in Kansas.

No, a notarized vehicle title is not required in Kansas.