Nexus doesn't just work with the nation's best car dealers. We curate interested buyers looking for your specific make and model.

- Chicago

- Aurora

- Naperville

- Schaumburg

- Joliet

- Rockford

- Springfield

- Peoria

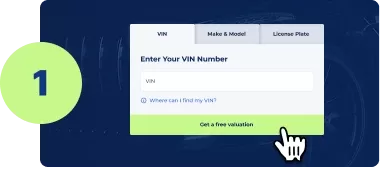

Our Car Value Calculator gives you a precise look at your used vehicle's value.

Auto dealers compete on our platform for your business, increasing value.

Enjoy around-the-clock support and valuable insights from our Nexus experts.

Nexus coordinates all transport arrangements once you sell a car in Illinois.

The less information you have, the lower your return will likely be.

There are no guarantees of interested buyers, let alone competition for your car.

You're responsible for everything, from advertising to shipping.

Popular car-buying sites like Carvana offer low value with no negotiations.

Nexus doesn't just work with the nation's best car dealers. We curate interested buyers looking for your specific make and model.

Selling a car privately in Illinois is one thing. Selling a car with a complete picture of its worth is another. Use our data insights to make more.

We are dedicated to the best customer care in the industry. Let our Portal staff help you find the right buyer for the right price. Contact us anytime!

Our Portal brings buyers to you. You don't have to spend weeks looking for them.

Our Car Value Calculator and customer support experts provide the data necessary to make informed decisions.

You can negotiate, sell, and manage car shipping on one intuitive platform.

Yes. It is against the law for a car buyer to reuse license plates registered by a car seller. Remove your plates and scrape off the registration stickers. You can then transfer or recycle your plates at a local Illinois Department of Motor Vehicles.

You can transfer license plates from an old car to another car you own or to an immediate family member. However, you may not transfer license plates when selling your car in Illinois or transferring a title.

To transfer license plates in Illinois, you must:

· Fill out a Request for Transfer of Vehicle Registration License Plates

· Include all necessary information, including name, address, license plate number, and pertinent information about the vehicle.

· If applicable, send a letter from the party transferring the plates that officially release liability.

The State of Illinois charges a 7.25% sales tax rate for car buyers, along with a $95 transfer fee and added tax based on the vehicle's age. Depending on the country, a vehicle purchase may include an extra 0.25% to 1% of county-assessed tax. Car buyers, not car sellers, are responsible for paying sales tax at the time of registration.

You pay taxes on all car sales that make a profit. Contact a local tax agency if you're unsure of the monetary difference between the price you paid for the car and the price you sold it for.

You may transfer vehicle titles online through the Illinois Secretary of State'sElectronic Registration and Title Vehicle Services portal.

No. Notarizing a bill of sale when selling a car in Illinois is not required. However, the Illinois Department of Motor Vehicles strongly suggests notarization, especially for complicated or high-value transactions.

No. you do not need to notarize a car title when selling a vehicle in Illinois.

Yes. Here are the steps you need to take to notify the Illinois after selling a car privately in Illinois:

· Cancel any active insurance policies on the vehicle.

· Complete an official title transfer.

· Fill out and mail a Notice of Sale form.

· Fill out a Seller's Report of Sale form.

Yes. You are required by law to have an official title and registration when selling your automobile in Illinois. Ensure all loans and liens are paid off or officially transferred before completing a used car sale in Illinois.

You are not required to complete an official bill of sale when selling an automobile in Illinois. However, it is strongly recommended that you do so to keep a legal record of the transaction.

Yes. A vehicle must pass an emissions inspection before a car buyer registers it in the State of Illinois.